Learn Crypto for Beginners: A Comprehensive Guide

Digital currency, often referred to as “crypto,” is a revolutionary form of digital money that operates on decentralized networks called blockchains.

Since BTC’s launch in 2009, thousands of cryptocurrencies have emerged, reshaping finance, technology, and Crypto investing.

For beginners, the crypto world can seem daunting with its technical jargon, volatile markets, and complex concepts.

This article serves as an accessible guide to help newcomers understand cryptocurrencies, how they work, and how to get started safely as of July 2025.

What is Digital currency?

Digital currency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit. Unlike traditional currencies issued by governments (fiat), cryptocurrencies are decentralized, meaning no single entity, like a bank or government, controls them.

They operate on blockchain technology—a distributed ledger that records all transactions transparently across a network of computers.

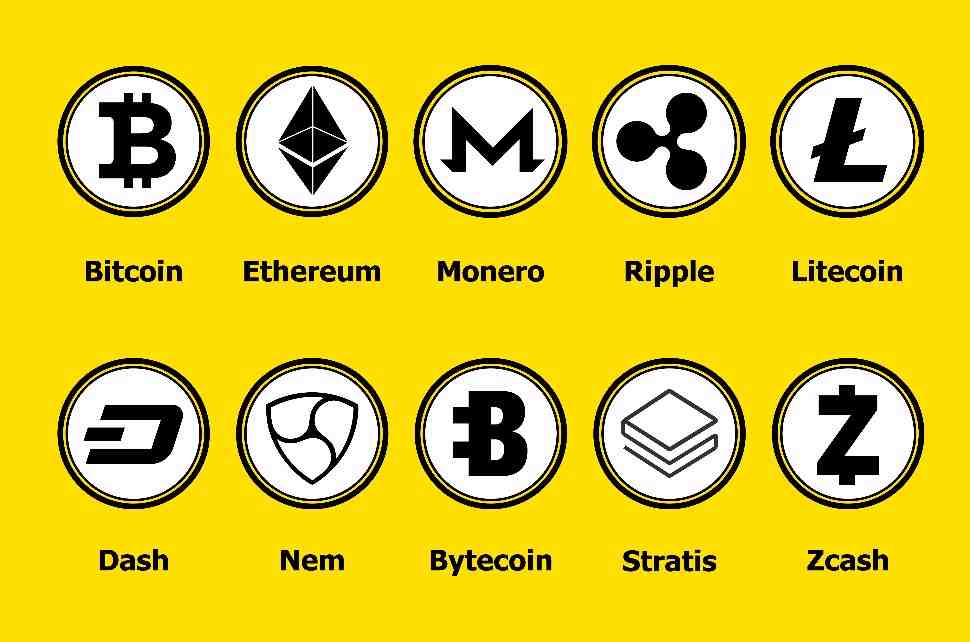

Popular cryptocurrencies include:

-

BTC (BTC): The first and most well-known, often called “digital gold.”

-

ETH (ETH): A platform for Blockchain contracts and decentralized applications (dApps).

-

Stablecoins (e.g., USDT, USDC): Pegged to assets like the U.S. dollar for stability.

-

Digital tokens: Thousands of other coins, like Solana, Cardano, and Binance Coin.

How Does Digital currency Work?

Blockchain Basics

A blockchain is a chain of blocks, where each block contains a list of transactions. These blocks are linked cryptographically and stored on multiple computers (nodes) worldwide.

This ensures transparency, Protection, and immutability—no one can alter past transactions without consensus from the network.

Key Components

-

Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets: Digital tools to store, send, and receive crypto. Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets have a public address (like a bank account number) and a Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet key (like a password).

-

Crypto mining: For some cryptocurrencies (e.g., BTC), miners use powerful computers to solve mathematical puzzles to validate transactions and earn rewards.

-

Decentralization: Transactions are verified by a network of nodes, not a central authority, reducing reliance on intermediaries.

-

Blockchain contracts: Self-executing contracts on blockchains like ETH, automating processes like payments or agreements.

Transactions

To send crypto, you use a Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet to create a transaction, which is broadcast to the network.

Nodes verify it, and once confirmed, it’s added to the blockchain. Transactions are pseudonymous—your identity isn’t directly tied to your Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet, but activity can sometimes be traced.

Why Learn About Crypto?

Cryptocurrencies offer unique opportunities and benefits:

-

Financial Inclusion: Crypto enables transactions in regions with limited banking access.

-

Crypto investing Potential: BTC and other coins have delivered significant returns, though with high risk.

-

Innovation: Crypto powers decentralized finance (Decentralized finance), non-fungible tokens (NFTs), and Web3 applications.

-

Hedge Against Inflation: Assets like BTC, with a fixed supply, may protect against Paper money devaluation.

However, crypto also comes with risks like Price fluctuation, scams, and regulatory uncertainty, making education critical for beginners.

Getting Started with Crypto

Step 1: Educate Yourself

Before diving in, learn the basics:

-

Understand Key Terms: Familiarize yourself with terms like blockchain, Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet, Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet key, and decentralized exchange (DEX).

-

Research Popular Coins: Start with BTC and ETH, then explore altcoins and their use cases.

-

Follow Trusted Sources: Read beginner-friendly content from sites like CoinDesk, CoinMarketCap, or Binance Academy. Avoid hype-driven social media posts.

Step 2: Choose a Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet

Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets come in two main types:

-

Hot Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets: Software-based, connected to the internet (e.g., MetaMask, Coinbase Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet). Convenient but less secure.

-

Cold Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets: Hardware-based, offline (e.g., Ledger, Trezor). Safer for long-term storage.

Always back up your Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet key or seed phrase and never share it. Losing it means losing access to your funds permanently.

Step 3: Buy Digital currency

You can purchase crypto through:

-

Centralized Exchanges (CEXs): Platforms like Coinbase, Binance, or Kraken allow you to buy crypto with fiat (e.g., USD, EUR). They’re user-friendly but require identity verification.

-

Decentralized Exchanges (DEXs): Platforms like Uniswap let you trade crypto directly from your Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet, offering more privacy but requiring technical know-how.

-

Peer-to-Peer Platforms: Services like LocalBTCs connect buyers and sellers directly.

Start small, only investing what you can afford to lose, as crypto prices are volatile.

Step 4: Secure Your Crypto investing

-

Enable Two-Factor Authentication (2FA): Protect exchange accounts with 2FA (e.g., authenticator apps).

-

Use Reputable Platforms: Stick to well-known exchanges with strong Protection records.

-

Avoid Scams: Beware of phishing emails, fake apps, or “get-rich-quick” schemes promising guaranteed returns.

-

Store Safely: Move significant holdings to a cold Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet for added Protection.

Step 5: Explore Use Cases

Once comfortable, experiment with crypto’s applications:

-

Payments: Use BTC or stablecoins for online purchases where accepted.

-

Decentralized finance: Lend, borrow, or earn interest on platforms like Aave or Compound.

-

NFTs: Buy or create digital collectibles on marketplaces like OpenSea.

-

Digital token locking: Earn rewards by locking up certain coins (e.g., ETH, Cardano) to support the network.

Key Risks to Understand

-

Price fluctuation: Crypto prices can swing dramatically. For example, BTC dropped from $69,000 in 2021 to under $17,000 in 2022.

-

Scams and Fraud: Ponzi schemes, fake ICOs, and rug pulls are common. Always verify projects before investing.

-

Regulatory Risks: Governments may impose restrictions, as seen in China’s crypto bans. Stay informed about local laws.

-

Technical Risks: Losing Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet keys or falling for phishing attacks can result in total loss of funds.

-

Environmental Concerns: BTC mining consumes significant energy, raising ethical questions for some investors.

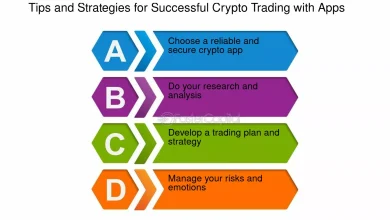

Tips for Beginners

-

Start Small: Invest only what you’re willing to lose. A common recommendation is 1–5% of your portfolio.

-

Diversify: Don’t put all your funds into one cryptocurrency. Explore BTC, ETH, and stablecoins for balance.

-

Stay Patient: Crypto markets are emotional. Avoid panic-selling during dips or chasing hype during rallies.

-

Learn Continuously: The crypto space evolves rapidly. Follow news, join communities (e.g., Reddit’s r/cryptocurrency), and take free online courses.

-

Use Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to reduce the impact of price Price fluctuation.

The Current Crypto Landscape (July 2025)

As of July 2025, the crypto market is maturing. BTC hovers between $50,000 and $80,000, bolstered by institutional adoption (e.g., BTC ETFs) and the 2024 halving. ETH’s shift to proof-of-stake (PoS) in 2022 has made it more energy-efficient, while Decentralized finance and NFTs continue to grow. Regulatory clarity is improving in some regions, but uncertainty persists in others. Scams remain prevalent, emphasizing the need for caution.

Resources for Learning

-

Websites: CoinMarketCap, CoinGecko (market data); Binance Academy, Coinbase Learn (tutorials).

-

Books: The BTC Standard by Saifedean Ammous; Mastering BTC by Andreas Antonopoulos.

-

Communities: Join Discord or Reddit groups, but verify information independently.

-

Courses: Free or paid courses on Coursera, Udemy, or Blockworks.

Common Mistakes to Avoid

-

FOMO Investing: Don’t buy during hype-driven price spikes without research.

-

Ignoring Protection: Failing to secure Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets or sharing Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallet keys can lead to losses.

-

Overleveraging: Avoid trading with borrowed funds (leverage), as losses can exceed your Crypto investing.

-

Trusting Unverified Projects: Research teams, whitepapers, and community feedback before investing in new coins.