Bitwise Chainlink ETF Filing Fuels Bullish Outlook as LINK Eyes $47

- Bitwise files for the first U.S. Chainlink (LINK) ETF, offering regulated exposure for investors.

- LINK accumulation hits a 180-day high, signaling strong long-term bullish momentum.

- ETF uses CME CF Chainlink–USD Reference Rate with Coinbase Custody for secure storage.

Bitwise Asset Management has officiallywith the U.S. Securities and Exchange Commission (SEC) for a Chainlink (LINK) exchange-traded fund (ETF).

If approved, this would become the first Chainlink-focused ETF in the United States, allowing investors to gain exposure to LINK through regulated financial markets.

The move highlights growing institutional demand for decentralized infrastructure tokens beyond BTC and ETH, positioning Chainlink as a potential leader among altcoins.

Inside the Bitwise Chainlink ETF Filing

According to the filing, the proposed ETF is structured to offer investors seamless access to LINK while maintaining Protection and regulatory oversight.

The ETF’s net asset value (NAV) will be calculated daily using the CME CF Chainlink–USD Reference Rate (New York), ensuring a transparent pricing model. Custody of LINK will be handled by Coinbase Custody, with assets stored in cold Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain wallets and protected by insurance coverage.

Shares will be created and redeemed in blocks of 10,000, either through in-kind LINK transfers or in cash. The fund will charge a unitary management fee (percentage yet to be disclosed), payable in LINK.

Also Read:

Market Reaction to ETF News

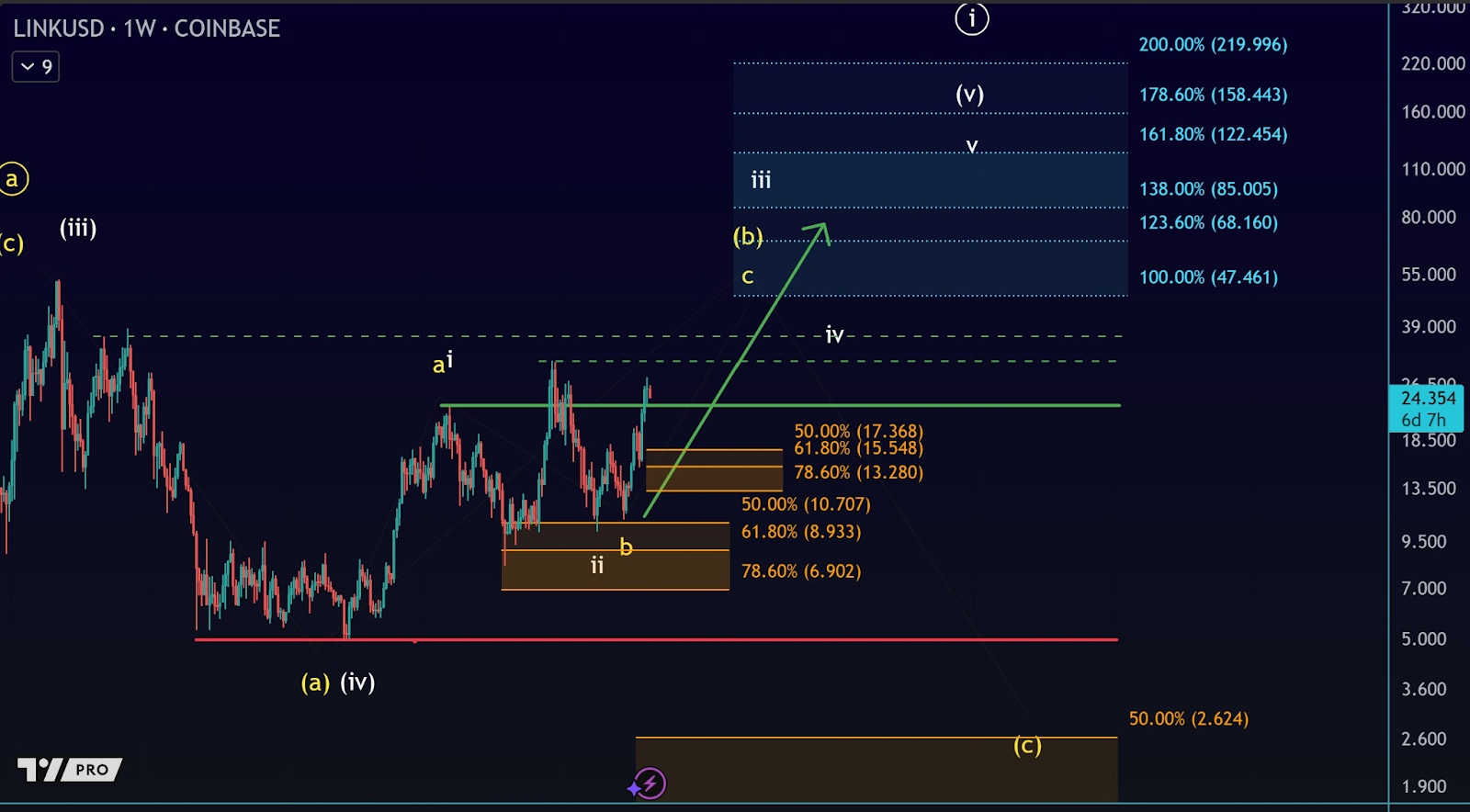

The ETF filing initially triggered optimism in the market, with LINK briefly surging and forming a strong green candle. However, broader crypto weakness has kept the token under pressure.

Source:

Currently, Chainlink is priced at $23.50, losing 4% over the last 24 hours. It has a market capitalization of $15.93 billion and a 24-hour volume of $1.79 billion.

Despite the bullish ETF catalyst, LINK is still lower on the daily and weekly charts, a result of the spillover effect from the recent decline of BTC to altcoins.

LINK Eyes $47 as Accumulation Peaks

In spite of the short-term fluctuations, Chainlink’s chart still maintains positive indicators. Statistics from More Crypto Online indicate that LINK has just recorded its highest 180-day trading volume, a sign of solid accumulations.

Major technical levels note $13.28 of critical support, and $31 is still the subsequent significant level of resistance.

Source:

If bullish momentum gathers, $47 is still in reach as a longer-term target. Both the ETF filing and a stabilization of the markets could act as a catalyst for this next leg higher.

Also Read: