HBAR at a Crossroads: Can It Hold $0.228 or Fall Further?

- HBAR faces a 0.78% drop in 24 hours, but trading volume rises 1.16%, reaching $380.17 million.

- Support at $0.228 is crucial, a bounce may retest $0.24, while a breakdown could lead to $0.19–$0.20.

- RSI and MACD show neutral to bearish sentiment, with declining trading volume and open interest.

Hedera (HBAR) is currently trading at with a 0.78% drop in the last 24 hours. Over the past week, the coin has lost value by 1.23%. The trading volume has shown a positive change, rising by 1.16% and is currently at $380.17 million.

Source:

This increase in trading volume shows that the market is more active in spite of the price Price fluctuation. The Price fluctuation and the growing interest around the asset are closely monitored by the investors in HBAR.

HBAR Tests Critical Support at $0.228

Crypto analyst CryptoPulse that HBAR is developing a descending triangle structure. The price is currently testing the critical Base level of $0.228, which will determine its future movement. If this support holds, it could lead to a potential retest of the $0.24 resistance.

However, if HBAR fails to maintain its position at this level, it could push the coin towards the demand range between $0.19 and $0.20. Such a decline may indicate that the market for the token is weakening further.

Source:

Also Read:

RSI and MACD Indicate Neutral Market Conditions

The Relative Strength Index is currently at 46.34 with a signal line at 49.53, putting HBAR in a neutral position. The coin’s level of oversold or overbought is low, indicating that it may continue to move sideways without any significant market changes.

MACD lines indicate fading bullish momentum. The MACD is -0.00118, the signal is at 0.00118, and the histogram is at -0.00236. This suggests that the market movement is slow and lacks strong buying interest.

Source:

Open Interest and Volume Decline, Pointing to Bearish Sentiment

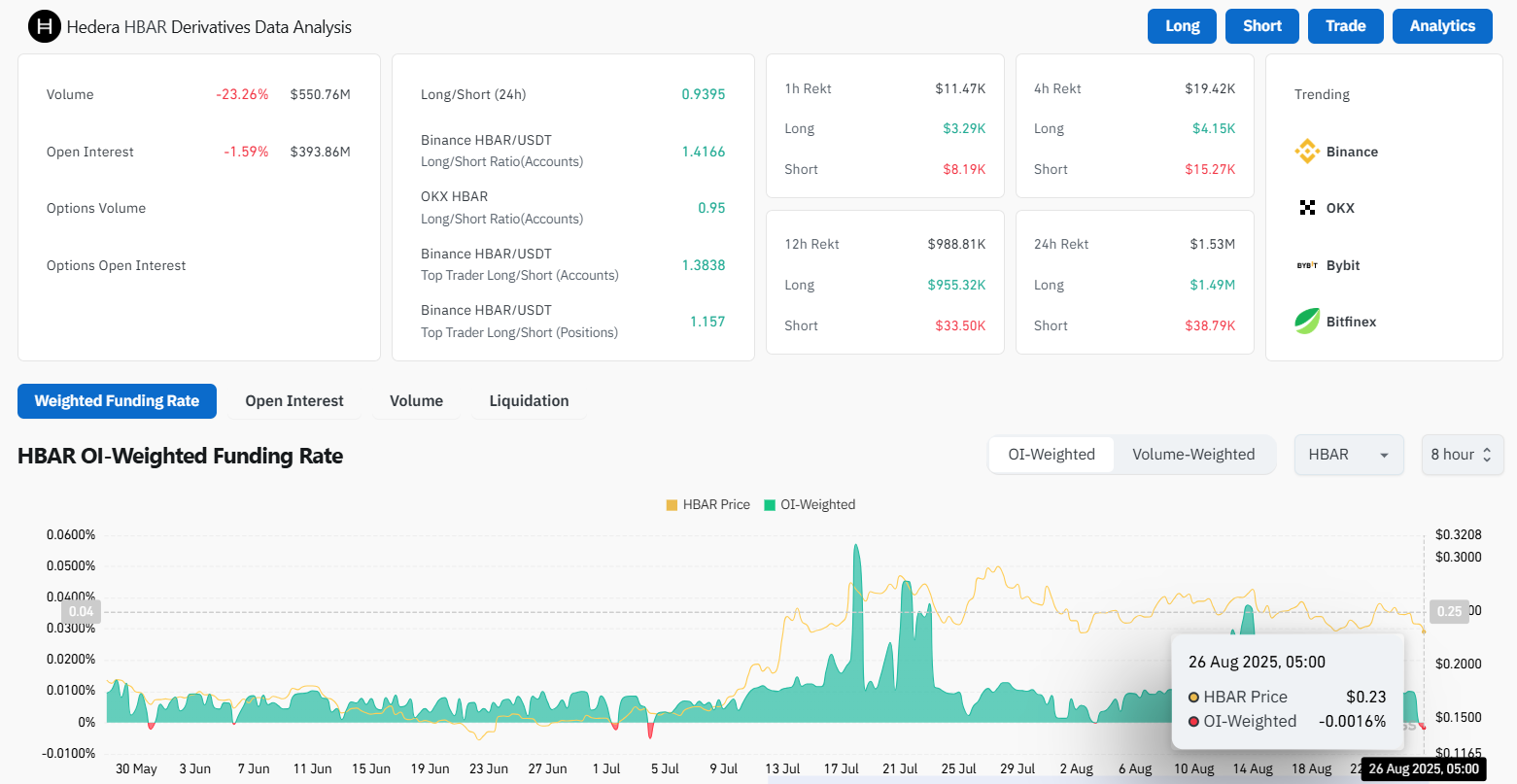

According to the CoinGlass , trading volume has decreased by 23.26% to 550.76 million dollars. The open interest has also decreased by 1.59% to $393.86 million. These numbers indicate a decline in market participation and a change in Investor sentiment.

The OI-weighted funding rate is at -0.0016%, signaling pessimistic expectations within the markets. That is an indication of prevailing bearish feelings in the market. Consequently, Investors tend to go short in expectation of additional price falls.

Source:

The outlook for HBAR is uncertain. The remaining week will determine whether it will be able to maintain its current level or if it will decline further. The trading range between the resistance of $0.24 and the support of $0.228 will constitute a critical area.

Also Read: